Brighten your future with financial advice

14 March 2025

According to research in Brighter Super and Investment Trends' 2024 Retirement Income Report1, preparedness for retirement has fallen to a 10-year low among people yet to retire. However, our research did reveal that the biggest differentiator of preparedness was acting after seeking information or guidance.

This is why Brighter Super believes that every member should retire with financial advice.

Getting the right financial advice can help you create a secure and comfortable future. For Brighter Super members, tailored financial guidance offers a pathway to maximising superannuation benefits, achieving financial goals, and ensuring peace of mind for a brighter retirement.

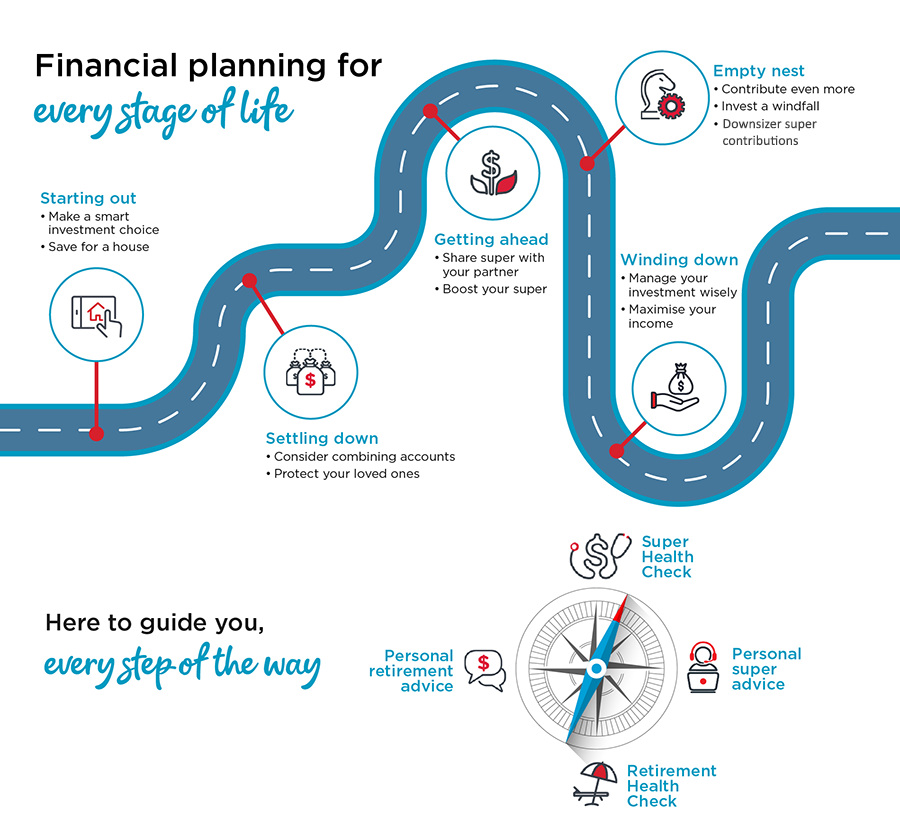

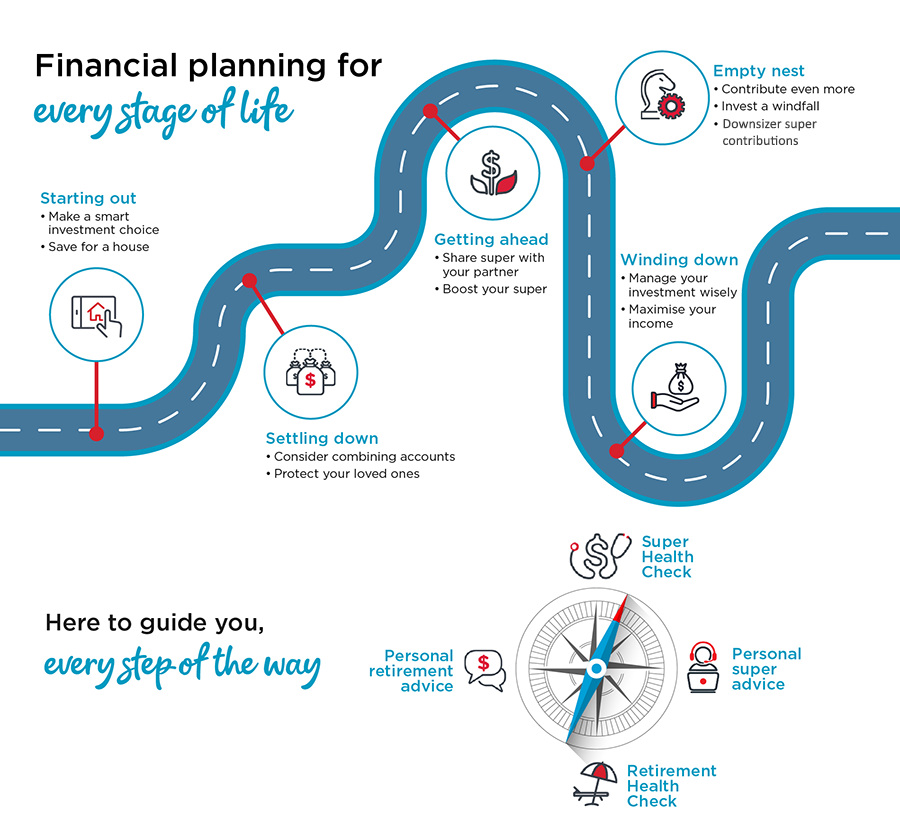

Whether you’re just starting your career, settling into family life, or preparing for retirement, financial advice from Brighter Super can help you confidently navigate each stage of life.

Taking the mystery out of financial planning

Many people hesitate to seek professional financial advice due to fear of the unknown. Questions like ‘What am I getting myself into?’ or ‘How will this benefit me?’ often prevent them from taking the first step.

Brighter Super’s advice services are designed to demystify the process, making it straightforward and accessible. Our financial advisers prioritise providing clear, easy-to-understand guidance, enabling members to focus on enjoying their retirement rather than worrying about their finances.

Our team of financial advisers offer members a range of financial advice services, including personal superannuation and retirement advice. We also have a network of over 1,480 independent financial advisers who are ready to support our members who prefer external advice.

Guiding you through all stages of life

While many members seek advice as they approach retirement, there are significant advantages to engaging with super specialists and financial advisers earlier in life.

The earlier you start planning, the more time you have to get the most out of contribution strategies and tax benefits, ultimately increasing your retirement savings.

Here’s a general overview of how financial advice can help across different life stages, although personal advice will always vary based on individual circumstances.

1. Starting out: building a strong foundation

For young adults, superannuation might not seem like a pressing priority. However, early engagement can lead to long-term rewards. Here’s how financial advice can help:

- Smart investment choices: Advisers can guide you in selecting an investment strategy suited to your age and risk tolerance. For younger members, this might mean choosing a high-risk strategy with higher growth potential, although this may also carry a greater risk of short-term losses.

- Consolidating super accounts: Many young Australians accumulate multiple super accounts, leading to unnecessary fees. Consolidating these accounts under the guidance of a financial adviser can save money and simplify management.

- Contributing more: Even small, regular contributions to your super early on can significantly boost your retirement balance thanks to compound returns.

- Taking advantage of the First Home Super Saver scheme: This program allows eligible members to save for their first home through their super fund.

2. Settling down: balancing competing financial priorities

For members in the settling-down phase, financial commitments often increase with home ownership and raising children. Superannuation may not be top of mind, but financial advice can ensure it remains part of your financial strategy:

- Salary sacrifice contributions: Advisers can help you set up a salary sacrifice arrangement, reducing your taxable income while growing your super balance.

- Reviewing insurance coverage: As family dynamics change, it’s important to ensure adequate life, disability, and income protection insurance through your super fund.

- Nominating beneficiaries: Establishing a binding beneficiary nomination ensures your super benefits are distributed according to your wishes.

3. Getting ahead: strengthening your financial position

As children grow older and financial pressures ease, members often have more disposable income to invest in their future. Financial advice during this stage can focus on the following:

- Spousal contributions: Adding to your partner’s super account can help balance retirement savings between partners.

- Boosting contributions: Using one-off payments such as bonuses or tax refunds to make additional contributions can significantly enhance your super balance.

- Planning for retirement: Reviewing your super strategy ensures alignment with your long-term goals.

4. Empty nest: accelerating retirement savings

With fewer immediate financial obligations, this stage is an ideal time to ramp up super contributions and prepare for retirement. Key strategies include:

- Transition to retirement strategies: Advisers can explain how to access your super while still working part-time, supplementing your income without fully retiring.

- Windfall investments: Lump sums from inheritances or redundancy payouts can potentially be invested in your super to enhance your retirement savings.

- Downsizer super contributions: Some members aged over 55 may be eligible to contribute proceeds from selling their home into their super, providing a substantial boost.

5. Winding down: navigating retirement

Retirement is a major life transition, and getting the financial aspects right is crucial. Financial advisers can provide guidance on:

- Managing investments: Ensuring your super continues to grow during retirement through tailored investment strategies.

- Maximizing income: Combining your super with government benefits such as the Age Pension to create a sustainable income stream.

- Budgeting for longevity: Developing a long-term plan to ensure your savings last throughout retirement.

Offering you a full range of advice options

Brighter Super is one of the few super funds nationally offering members a full range of financial advice options. This includes Super Health Checks, Retirement Health Checks, and personal superannuation and retirement advice.

General advice and limited advice about super are available to Brighter Super members at no additional cost. Costs for personal advice such as comprehensive advice and retirement planning will depend on the type and complexity of advice.

While we have an in-house team of financial advisers and superannuation specialists, we know and respect that some members prefer to seek external advice. With this in mind, we currently have a network of 1,480 independent financial advisers who are registered with us.

Talking to one of our in-house or independent financial advisers can help you achieve the following:

- Explore opportunities to grow your super, maximising your retirement savings.

- Provide clarity on complex topics such as contributions, tax savings, and government benefits.

- Create a plan to achieve a more comfortable lifestyle in retirement.

- Protect you and your family in the event of death, illness or disability.

Our team can help you identify your needs and make the right decisions for your future. To learn more, read more about our financial advice services.

Take the first step toward a brighter future

To explore your financial advice options or book an appointment, contact us on 1800 444 396 or advice@brightersuper.com.au.

Taking the step to seek professional financial advice can be transformative, ensuring you’re on track to achieve a comfortable and secure retirement. Whether you’re starting out, settling down, or preparing for retirement, Brighter Super is right by your side every step of the way.

- Brighter Super and Investment Trends 2024 Retirement Income Report, available at brightersuper.com.au/retirement-income-report

The information in this document is based on a quantitative online survey of 5,315 Australian adults aged over 40 conducted by research partners Investment Trends between July and August 2024. Comparisons have been drawn from previous surveys conducted by Investment Trends. The survey was conducted in two phases, a main industry-level survey of Australian adults sourced from a broad-based survey of the Australian adult population, supplemented with respondents from the Investments Trends opt-in panel. An additional sample of respondents was invited to the survey from a range of Investment Trends’ institutional clients. They reflect the demographic profile of members holding an account with these institutions and were included in the survey, where appropriate, to conduct detailed analysis of particular sub-groups for which they are representative. The maximum sampling error (centre of the range) at the 95% confidence interval is +/-1.2%. Analysis of subgroups will have a higher sampling error. Where appropriate respondents were post weighted slightly to ensure distribution by sample, age, gender, location, superannuation fund type superannuation balance and age pension coverage.

Brighter Super Trustee (ABN 94 085 088 484 AFS Licence No. 230511) ("Trustee") as trustee for Brighter Super (ABN 23 053 121 564) ("Fund"). Brighter Super may refer to the Trustee or the Fund as the context may be. Brighter Super products are issued by the Trustee on behalf of the Fund. The information contained is up to date at the time of publishing. Some of the information may change following its release. Any questions can be referred to Brighter Super by calling 1800 444 396, or by emailing info@brightersuper.com.au.

This article may contain general advice, which has been prepared without taking into account your individual objectives, financial situation or needs. As such, you should consider the appropriateness of the advice to your objectives, financial situation and needs before acting on the advice. You should also obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) before making any decision to acquire any product or contribute additional amounts to your Brighter Super account. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the PDSs, FSG and TMDs at brightersuper.com.au/pds-and-guides.