Aiming for the stars: Brighter Super invests in Queensland’s space future

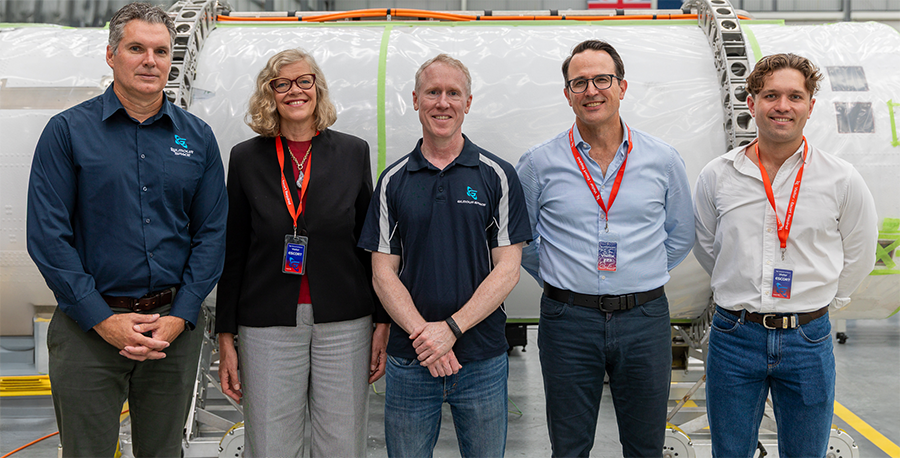

L-R Gilmour Space Technologies CFO Ashley Hasforth, Brighter Super CEO Kate Farrar, Gilmore Space Technologies CEO Adam Gilmour, QIC Ventures’ Nick Guest and Nick Capell

23 January 2026

Brighter Super is quite literally aiming for the stars, backing Queensland-based Gilmour Space Technologies as it helps propel Australia into the global space economy.

Through the $50 million Venture Capital Mandate with Queensland Investment Corporation (QIC) and as part of our Queensland Investment Strategy, Brighter Super has invested in one of the nation’s most advanced and future-focused technology companies. This investment aims to support innovation, high-skill jobs and solid long-term returns for members.

Founded on the Gold Coast in 2013 by brothers Adam and James Gilmour, Gilmour Space Technologies has built a diversified space services platform spanning orbital launch, satellite manufacturing and hypersonic capabilities.

Now headquartered in Yatala, the company operates a 10,000-square-metre advanced manufacturing facility and owns and operates Australia’s first and only licensed orbital spaceport in Bowen, Queensland. Together, these assets are firmly placing Queensland on the global space map.

Brighter Super Chief Executive Officer Kate Farrar said the investment reflects the fund’s broader commitment to backing future-focused Queensland businesses while delivering strong long-term returns for members.

“Gilmour Space Technologies is leading Australia’s progress in the global space sector, while also building critical sovereign capabilities across commercial activity and scientific research.

“It’s a powerful example of how member capital can support Queensland innovation and help it reach new heights,” Ms Farrar said.

A major milestone for Australia’s space industry

Gilmour Space Technologies reached a major milestone on 30 July 2025 when it conducted Australia’s first launch attempt of a locally built orbital rocket on home soil. The series E funding round, led by the National Reconstruction Fund and Hostplus, and supported by the Future Fund, Hesta, Funds SA, NGS Super in addition to QIC and Brighter Super will enable further test launches to develop the technology.

The company is now one of only three companies globally, and the first in Australia, to own and operate end-to-end orbital launch services, with both its own launch vehicle, the Eris rocket, and its own licensed launch site. The company is also advancing its hypersonic program, providing suborbital flight test service in Australia targeting commercial and defence customers.

The investment delivers strong local benefits, with Gilmour Space Technologies employing more than 220, many in highly technical roles. The company also partners with Queensland universities to support talent development, high-skill job creation and advanced manufacturing capability across the state.

Supporting long-term growth for members

The new funding will support the continued development of the Eris orbital rocket technology and contribute towards Gilmour Space Technology’s ambitions to scale satellite and rocket manufacturing.

Brighter Super’s investment was made in December 2025 as part of Gilmour Space Technologies’ Series E fundraising, representing 3.6 per cent of the fund’s $50 million Venture Capital Mandate with QIC.

The Series E fundraising has secured $217 million investment, reflecting strong investor confidence in Gilmour Space Technologies’ growth trajectory and its ambition to take Australian capability to the world.

Brighter Super builds momentum with QIC backed venture capital investments

Brighter Super is strengthening Queensland’s future by backing innovative, high potential local companies through its $50 million Venture Capital Mandate with QIC. With over a quarter of the mandate already deployed, the fund is supporting emerging leaders across advanced manufacturing, space, robotics, agritech and industrial software - sectors where Queensland holds clear competitive advantages.

Momentum is accelerating, with a growing pipeline of opportunities expected to deliver strong long-term value for members while driving the growth of homegrown industries. Each investment contributes to the creation of skilled jobs, supports technological advancement, and helps position Queensland as a global leader in next generation sectors.

These venture capital investments are a cornerstone of Brighter Super’s Queensland Investment Strategy, designed to grow members’ retirement savings while helping build a more resilient, productive and future focused state economy. In partnership with QIC, Brighter Super is laying the foundation for sustained economic growth and ensuring Queensland innovators have the capital and support they need to succeed.

In May 2024, Brighter Super announced its Queensland Investment Strategy, committing to invest a further $500 million in Queensland-based assets, in addition to the $1 billion already invested across the state. This strategy aims to drive sustainable growth and deliver positive, long-lasting outcomes for members and their communities. Through mandates and investments with Riparian Capital Partners, Barings and QIC, Brighter Super is reinforcing its role as a key investor in Queensland’s economic future.

For more information on the Brighter Super Queensland Investment Strategy.

Brighter Super Trustee (ABN 94 085 088 484) (AFSL 230511) (the Trustee) as trustee for Brighter Super (ABN 23 053 121 564) (RSE R1000160) (the Fund). Brighter Super may refer to the Trustee or the Fund as the context may be. Brighter Super products are issued by the Trustee on behalf of the Fund. Visit

PDS and Guides.