What new tariffs mean for markets and your super

4 April 2025

Global share markets have been impacted recently following the speculation and subsequent introduction of new US import tariffs that have raised concerns about global trade and the economic outlook.

As investors try to digest the implications of the new policy agenda, we’re seeing volatility in various markets such as shares, currency and bond markets.

At Brighter Super, we know that market ups and downs can feel unsettling, especially when headlines are changing quickly. But it’s important to remember that super is a long-term investment. Our diversified approach is designed to help smooth out periods of volatility, to help protect your retirement savings through changing market conditions.

Our guidance through volatility remains the same: stay calm and stay the course.

This stands true for our members in the accumulation and/or pension phase.

Focus on long term growth

It's natural to worry about market volatility during significant policy changes.

Superannuation funds are designed for long-term growth, and while short-term market fluctuations can occur, the long-term outlook remains positive. Historically, markets have shown resilience and the ability to recover from policy and economic uncertainties.

Brighter Super’s investment strategy emphasises diversification and risk management, spreading investments across various asset classes, regions, and managers to minimise the impact of any single event on your portfolio. This approach helps protect your superannuation from potential market swings and ensures balanced growth over the long-term.

Brighter Super investment update

Our disciplined investment strategy continues to deliver solid, competitive returns for members – reinforcing our commitment to long-term financial security and growth.

Super funds are designed for long-term growth. While short-term market ups and downs are natural, history shows that markets recover and grow over time. Staying calm and focusing on the long-term can help you stay on track through periods of volatility.

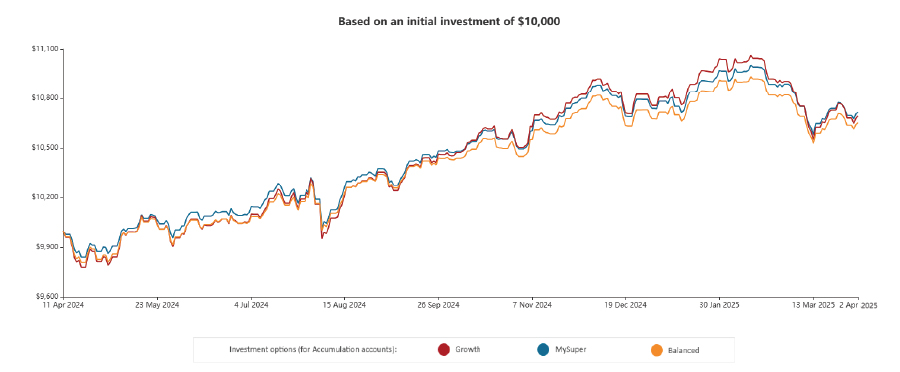

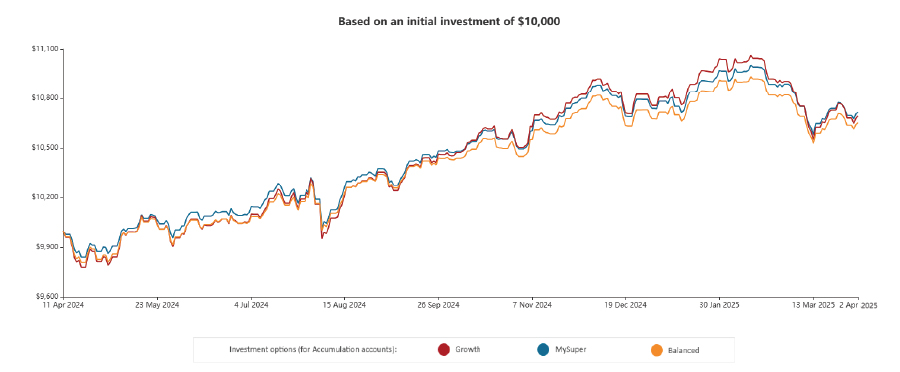

The graph below highlights how we have delivered steady growth despite short-term fluctuations, based on an initial investment of $10,0001.

You can explore how your investments are performing with our interactive performance graph, which lets you track all our investment options for accumulation and pension over your chosen period.

Stay calm and stay invested

After navigating every major financial crisis since the 1987 stock market crash, Brighter Super’s Chief Investment Officer Mark Rider has some sage advice for superannuation members nervous about recent market turbulence.

‘Keep calm and stay the course,’ Mr Rider says.

During times of uncertainty, it's best to stay the course and avoid making hasty decisions based on short-term market movements. Our investment managers and the Brighter Super Investment team are dedicated to managing your funds with a focus on long-term growth and portfolio diversity.

Switching investment options during a market downturn can solidify losses and potentially cause you to miss out on the eventual recovery. While cash and fixed interest investments can reduce overall portfolio volatility, relying solely on them may result in a lack of exposure to growth assets like shares and property, which are important for keeping up with inflation in the long term.

Brighter Super’s Chief Investment Officer, Mark Rider, shared his insights and lessons learned in a recent article on protecting your finances during market volatility.

Keep calm and stay invested: Mark Rider’s essential advice to beat market turbulence

1. The values provided in the graph represent past performance only. Past performance is not a reliable indicator of future performance. Investment returns are not guaranteed. Investment returns are net of investment fees, transaction costs and taxes (where applicable) and gross of administration fees. The figures shown in the graph are based on an initial investment of $10,000 at the start date of your chosen investment period, or at the option's commencement date if it launched after the start date of your investment period. The values shown in the graph are based on unit prices which have been derived from each option's interim daily unit prices. The values of investment do not take into account any withdrawals or contributions.

Changes to fees, asset allocations, return targets and risk levels all play a significant role in the performance of each investment option. These factors are subject to change in the future. Each of our investment options has a different return target and risk level. When deciding how to invest your money consider your overall investment objectives, tolerance for risk and timeframe for investing.

Brighter Super Trustee (ABN 94 085 088 484 AFS Licence No. 230511) ("Trustee") as trustee for Brighter Super (ABN 23 053 121 564) ("Fund"). Brighter Super may refer to the Trustee or the Fund as the context may be. Brighter Super products are issued by the Trustee on behalf of the Fund. The information contained is up to date at the time of publishing. Some of the information may change following its release. Any questions can be referred to Brighter Super by calling 1800 444 396, or by emailing info@brightersuper.com.au.

This article may contain general advice, which has been prepared without taking into account your individual objectives, financial situation or needs. As such, you should consider the appropriateness of the advice to your objectives, financial situation and needs before acting on the advice. You should also obtain and consider the Product Disclosure Statement (PDS) and Financial Services Guide (FSG) before making any decision to acquire any product or contribute additional amounts to your Brighter Super account. A Target Market Determination (TMD) is a document that outlines the target market a product has been designed for. Find the PDSs, FSG and TMDs at www.brightersuper.com.au/pds-and-guides.