Women’s retirement confidence drops as income gap expands to $1,500 per month

28 March 2025

Women are growing increasingly pessimistic about their retirement prospects, as the gap between expected and required income for a comfortable retirement widens to a median of $1,500 per month in 2024.

This is according to the latest findings from Brighter Super and Investment Trends' 2024 Retirement Income Report. By comparison, men expect a lower shortfall of $1,100 per month1.

The report reveals a growing gender disparity in retirement preparedness. With 71% of pre-retiree women now anticipating a funding shortfall in retirement, up significantly from 62% in 2023. In contrast, 54% of men expect a shortfall, up from 48% the previous year.

A gendered retirement challenge

The latest data underscores the persistent financial challenges women face in securing a comfortable retirement. In 2023, the expected median funding gap stood at $1,200 per month for women and $1,000 for men.

To mark International Women’s Day 2025 earlier this month, Brighter Super and Investment Trends released an in-depth gender analysis of retirement preparedness, based on exclusive findings from the 2024 Retirement Income Report.

Women’s retirement preparedness is a concern

The survey revealed that women feel less prepared for retirement than men and have more retirement concerns.

- Level of preparedness: When asked how well prepared they feel for retirement, 78% of women don’t feel prepared, compared to 64% of men.

- Lower engagement: Women are more likely to say they haven’t thought about it when asked about how they intend to close the retirement funding gap. 20% of pre-retiree women said so, compared to 13% of men.

- Different strategies: Among those who had thought about it, women were more likely to make additional super contributions to close their funding gap or reduce spending, whereas men were more likely to delay retirement or move to investments with higher growth.

- Limited awareness of super products: 66% of female pre-retirees were not sure if their main super fund offered retirement income products, compared to 55% of male pre-retirees.

- Uncertainty at preservation age: 38% of female retirees were unsure about their next steps upon reaching the preservation age of 60, compared to 29% of male pre-retirees.

- Retirement timing: Women were more likely to retire earlier than planned, with 51% of female retirees reporting early retirement, compared to 43% of men.

Bridging the retirement preparedness gap

Brighter Super Head of Retirement Jennifer McSpadden said the findings reinforce that women are lagging in retirement preparedness but have opportunities to take proactive steps to secure their financial future.

‘Not contributing more to super was by far the most common regret among retirees, with 38% expressing this concern,’ McSpadden said.

McSpadden said, ‘The survey found that taking action after seeking guidance was a key driver of retirement preparedness.’

The survey found information and guidance is the biggest differentiator in preparedness, with 55% of pre-retirees feeling prepared after seeking advice.

‘At Brighter Super we are committed to bridging the advice gap to ensure more women receive the guidance they need.’’

Seeking clarity on retirement needs and incomes

Ms McSpadden emphasised the importance of women taking charge of their super, given that they tend to live longer than men. According to the Australian Bureau of Statistics in 2024, a 60-year-old Australian woman can expect to live another 27.1 years, compared to 24.2 years for an Australian man of the same age 2.

When asked which areas they wanted more information to better prepare for retirement, almost 50% of women pre-retirees want to know how much they need to retire comfortably. The next highest responses among women were:

- How to improve their retirement outcome and

- How much they are likely to receive from super in retirement.

More confidence among Brighter Super members

The survey found that Brighter Super female members felt more prepared for retirement than the national average. Among Brighter Super members, 29% of women felt prepared, compared with 22% nationally. Additionally, 55% of Brighter Super female pre-retirees trusted their fund’s ability to guide them in retirement, compared to 48% of women nationwide.

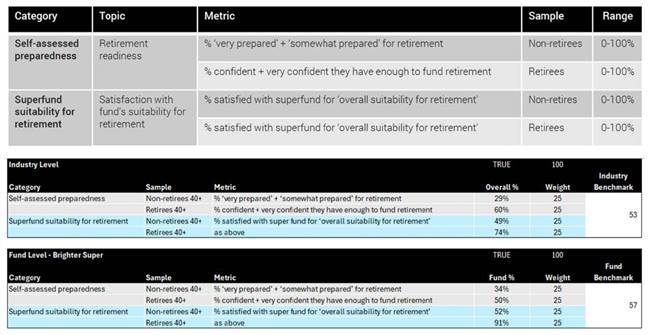

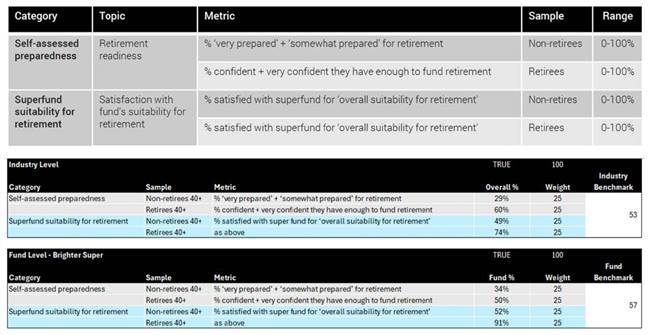

Retirement Readiness Index: Women lag behind, but Brighter Super members fare better

The Brighter Super and Investment Trends Retirement Readiness Index (RRI)3 found Australian women aged over 40 were less confident about retirement, with an RRI of 51 compared to 56 for men.

Brighter Super female members, however, had a significantly higher RRI of 65, well above the national average.

The RRI equally weighs four factors:

- How pre-retirees rate their super fund’s suitability for retirement

- Pre-retirees’ confidence in having enough funds for retirement

- Retirees’ satisfaction with their super fund and how well prepared they feel for retirement.

- The information in this document is based on a quantitative online survey of 6,743 Australian adults aged over 40 conducted by research partners Investment Trends between July and August 2024. Comparisons have been drawn from previous surveys conducted by Investment Trends. The survey was conducted in two phases, a main industry-level survey of Australian adults sourced from a broad-based survey of the Australian adult population, supplemented with respondents from the Investments Trends opt-in panel.

An additional sample of respondents was invited to the survey from a range of Investment Trends’ institutional clients. They reflect the demographic profile of members holding an account with these institutions and were included in the survey, where appropriate, to conduct detailed analysis of particular sub-groups for which they are representative. The maximum sampling error (centre of the range) at the 95% confidence interval is +/-1.2%. Analysis of subgroups will have a higher sampling error. Where appropriate respondents were post weighted slightly to ensure distribution by sample, age, gender, location, superannuation fund type superannuation balance and age pension coverage.

Derived from the Brighter Super and Investment Trends 2024 Retirement Income Report, the index is based on a quantitative online survey of 5,315 Australian adults aged over 40 – including 991 from Queensland in July and August 2024. Ready for Retirement Index figures were retrospectively calculated using data from the 2023 Investment Trends Retirement Income Survey.

- Australian Bureau of Statistics media release: Australian life expectancy decreases for second year in a row.

- How the Retirement Readiness Index is calculated:

Methodology: Comparisons have been drawn from previous surveys conducted by Investment Trends. The survey was conducted in two phases, a main industry-level survey of Australian adults sourced from a broad-based survey of the Australian adult population, supplemented with respondents from the Investments Trends opt-in panel. An additional sample of respondents was invited to the survey from a range of Investment Trends’ institutional clients. They reflect the demographic profile of members holding an account with these institutions and were included in the survey, where appropriate, to conduct detailed analysis of particular sub-groups for which they are representative. The maximum sampling error (centre of the range) at the 95% confidence interval is +/-1.2%. Analysis of subgroups will have a higher sampling error. Where appropriate respondents were post weighted slightly to ensure distribution by sample, age, gender, location, superannuation fund type superannuation balance and age pension coverage.

Brighter Super Trustee (ABN 94 085 088 484 AFS Licence No. 230511)(‘Trustee’) as trustee for Brighter Super (ABN 23 053 121 564) (‘Fund’). Brighter Super may refer to the Trustee or the Fund as the context may be. Brighter Super products are issued by the Trustee on behalf of the Fund. This media release provides general information only and does not take into account your individual objectives, financial situation or needs. You should consider whether it is appropriate for your needs prior to making any decisions and consult a licensed financial advisor if you require advice. Obtain and consider the Product Disclosure Statement and Target Market Determination before making any decision to acquire any products. Visit https://www.brightersuper.com.au/pds-and-guides