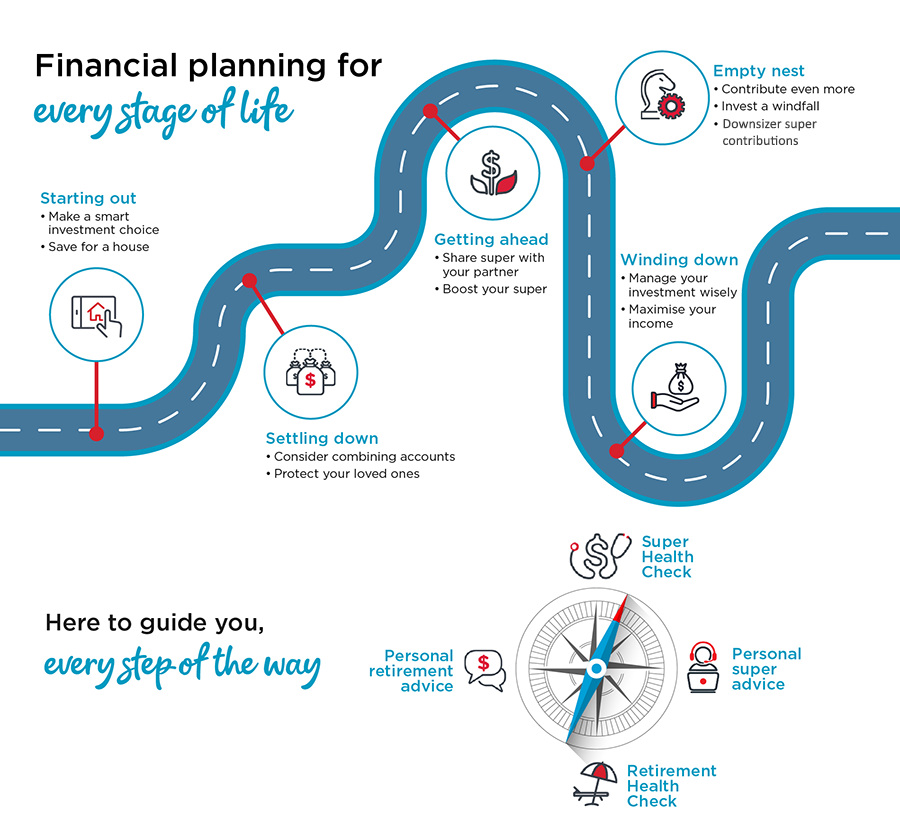

Financial planning for every stage of life

1 July 2024

When people think of financial planning, they often associate it with imminent retirement. They may assume it relates to investing retirement savings, accessing more of the Age Pension, or drawing income from superannuation to support retirement living.

It is that, but a whole lot more too. And if you embrace financial planning early in life it can act as a roadmap for your financial future, helping you along the way to budget better, reduce debt faster, save and invest money, increase your super balance, and even protect yourself and your loved ones.

Your superannuation forms a key part of this roadmap, so understanding its value and how to make the most of it through different stages of your life can lead to a more rewarding and secure future.

Starting out

It’s understandable that young adults have better things to do than worry about the future, so superannuation is often an afterthought, at best.

However, those who are prepared to engage early with their super can reap the rewards, thanks mainly to the advantage of time which allows them to recover from market fluctuations and benefit from the power of compound interest.

Financial planning opportunities to consider while you are young and starting out include:

- Make a smart investment choice: Many people choose the default MySuper option for their super, which typically offers a balanced portfolio with moderate risk. However, superannuation is designed to provide an income in retirement, which is often far in the future. Young adults can often benefit from a more aggressive investment strategy, including greater exposure to Australian and international shares and property assets, to potentially achieve higher growth over the long term.

- Consolidate multiple accounts: Young Australians – particularly those working in casual or part-time roles – tend to change employers more frequently, often resulting in the collection of several super fund accounts. By consolidating your super into just one account, you could save money on administration fees and reduce unnecessary paperwork. However, it’s important to consider what is best for your situation. Compare your super funds and choose the one you think will give you the best long-term outcome. You should also check whether this could have an impact on your contributions, fees, tax situation or insurance cover.

- Contribute more: We know every dollar is precious when you’re young and on a budget, but if you can allocate even small, regular amounts to your super, you can significantly increase your final balance at retirement due to compounding over time.

- Save for a house: The First Home Super Saver (FHSS) scheme allows you to save for your first home by making additional contributions into your super fund, with the potential for lower tax and higher returns than traditional savings options. And when the time is right, to access these contributions to help fund your first home.

Settling down

When you start to settle down, perhaps with a life partner or young children, things get more serious. Australians in this life stage face numerous, often competing financial commitments such as saving for a home or managing a mortgage, paying the bills, and saving for their children's education.

Again, it’s understandable that super is not top of mind during this time, but it’s important to dedicate some time and effort to long-term financial planning.

Considerations for Australians who are settling down include:

- Consolidate multiple accounts: If you still have multiple super accounts, it’s likely you’ve been paying additional fees for several years now so you may want to consider consolidating sooner rather than later. However, it’s important to consider what is best for your situation. Compare your super funds and choose the one you think will give you the best long-term outcome. You should also check whether this could have an impact on your contributions, fees, tax situation or insurance cover.

- Contribute more: Money is probably tight, so a smart option may be to contribute additional funds to superannuation through a salary sacrifice arrangement. This is an agreement with your employer to sacrifice some of your pre-tax salary to super, so it’s taxed at a lower rate and you’ll also reduce the tax on your take-home pay.

- Protect your loved ones: Once you have a family or dependants, it’s important to ensure you have adequate life, disability and income protection insurance to support yourself and your family if you were not able to work for a period of time. If you have insurance in your super fund, it may not be enough to meet your needs so now’s the time to review your level of cover and apply for an increase if needed.

- Nominate a binding beneficiary: As your super can play an important role in supporting your dependants after your death, it’s important to consider where you want to direct your super and any applicable insurance benefits. A binding death benefit nomination is a legal document that binds Brighter Super to pay your benefit to your nominated beneficiary and is particularly useful if you have a more complex family situation (for example, an ex-partner or children of former relationships).

Getting ahead

As your children reach their teenage years, the costs of raising a family can increase but there can also be some financial relief if you’ve had a promotion or made a dent in the mortgage, or if both partners are working and bringing in a higher income than during the early years.

If things have become a bit easier financially, it’s a good time to review and update your super in line with the ‘settling down’ suggestions, but also consider fast-tracking your super balance:

- Share super with your partner: If one partner earns a lower income or has taken time off work over the years to raise children, there may be a substantial difference in superannuation balances between partners. This may give you an opportunity to add to the lower-balance partner’s super, either by making a spouse contribution directly to their account or by splitting some of the contributions made to your own account with your partner.

- Boost your super: If you haven’t already, it’s worth considering contributing regularly to your super via a salary sacrifice arrangement, but you can also make one-off or regular contributions from your after-tax pay. You may want to do this with some or all of an annual bonus or annual tax refund, if the funds aren’t committed elsewhere.

Empty nest

Once the kids reach adulthood and their own ‘starting out’ phase, you’re likely to have a lot more time to focus on yourself and your future.

With retirement not necessarily around the corner, but perhaps a lot closer than it seems, it’s time to ramp up your financial planning efforts to ensure you’re in a good place when you want – or need – to finish working. Keep in mind, not everyone gets to finish work on their own terms and may need to bring retirement forward due to circumstances outside their control – think redundancy, health concerns, or caring for an elderly parent – so preparing as early as possible will help provide the flexibility you may need later.

Things to consider in setting up your super for retirement include:

- Work the numbers: With retirement creeping ever closer, consider how much super you think you might need, what sort of income that will provide, and how long it will last. Check out our calculators or, even better, book in a Retirement Health Check for a personalised assessment.

- Contribute even more: With super being the most tax-effective way to save for retirement, it makes sense to increase contributions as much as possible once you have more disposable income. But while it may be tempting to load up as much as you can afford, keep in mind there are annual contribution caps.

- Choose life over work: If you’d like to reduce your workload but not your income, your super fund may be able to help. A Transition to Retirement Pension account can provide regular pension payments from your super to supplement the income you have lost by cutting back your work hours or taking a lower paying job. A financial adviser can take you through the ins and outs of this strategy to ensure it’s right for you.

- Invest a windfall: In the empty nest stage of life, it’s not uncommon to receive a lump sum of money in the form of an inheritance or redundancy. While you may want to use some of this for lifestyle goals such as renovations or travel, consider the benefits of investing at least a portion of the windfall in your super to give it a late boost.

- Downsize your home: One of the most attractive benefits in this life stage is the opportunity for Australians aged 55 or over to contribute up to $300,000 ($600,000 per couple) to super from the sale of their home. This is a terrific way to boost your super in the lead-up to retirement while potentially also improving your lifestyle.

Winding down

Once you’ve reached your superannuation ‘preservation age’ and are ready to retire, it’s time to convert your super from the accumulation phase to the drawdown phase. This will allow you to receive an income from your super that can supplement your Age Pension entitlements and support your lifestyle in retirement.

This transition can be hard to get right, with much to consider in terms of tax rules, superannuation legislation, how and where to invest, short and long-term budgeting needs, and Centrelink eligibility.

Most Australians going through this transition are likely to benefit from professional financial advice – at this time more than any other – to help you:

- Manage your investment wisely: Even though you may have stopped working, your super doesn’t need to. You still have the flexibility in a pension account to manage your money so you have enough to draw on in the short term, while the rest is invested to grow and provide a strong and steady income.

- Maximise your income: Most Australians don’t fully fund their own retirement but rely on a combination of personal income from super and other assets, and the government’s Age Pension. A financial adviser can improve your understanding of the Centrelink benefits you could receive and the potential impact these could have on your financial position.

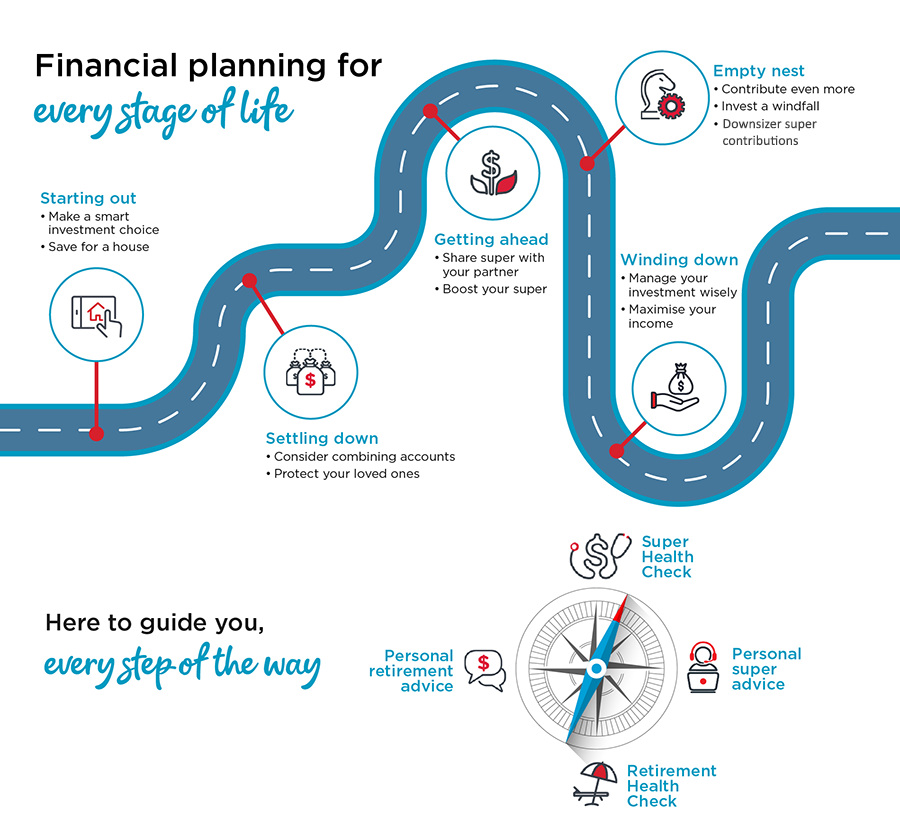

Helping you plan, grow and protect

Brighter Super offers a range of financial planning and advice services to help you get the answers you need about your super, learn how to make it work to your advantage at any stage of life, and plan for a better financial future.

Fees apply to some of our personal advice services, which are shown on or Financial Advice page.

Our services include:

- Super Health Check

A Super Health Check is a 30-minute phone appointment with one of our superannuation specialists, at no additional cost. We can help you discover new ways to grow your superannuation, and check that you are on track for a comfortable retirement.

- Personal super advice

Brighter Super members can receive limited advice about their super, at no additional cost. Topics include choosing an investment option, selecting appropriate insurance within the fund, and considering ways to grow your super.

- Retirement Health Check

Members aged 55 or over may benefit from a 30-45 minute phone appointment with a Brighter Super financial adviser to help project your retirement savings, determine how long your money will last in retirement, and consider your eligibility for the government’s Age Pension.

- Personal retirement advice

A Brighter Super financial adviser can help you plan for a brighter retirement with personal financial advice on retirement adequacy, transition to retirement, commencing an account-based pension, and determining your Centrelink entitlements.