Market update: Our competitive performance in a challenging year

By Mark Rider, Chief Investment Officer, Brighter Super

18 August 2022

The last year has been a tale of two halves for financial markets. We saw growth and optimism in the first half, followed by war, inflation and markets falling in the second half.

A rapid market cycle from upturn to downturn in the past year had positive and negative impacts on investments. Despite the volatility facing all super funds, Brighter Super's diversified portfolio delivered competitive returns for members.

The challenges of financial year 2021/22 are a reminder that superannuation is a long-term investment, and one which can often take you through many cycles of short-term downturn and volatility.

Optimism turns to caution

The year started with optimism as economies worldwide continued their recovery from the COVID-19 slowdown. Share markets worldwide finished the first half of the year on a high.

This period of positive returns was followed by a change in investor sentiment, with a de-rating across various stocks and sectors due to economic and valuation concerns. Global share markets fell further than the domestic market, which was protected for a time by increasing commodity prices.

A sharp increase in bond yields from extremely low levels was one of the past year’s defining trends in financial markets. Central banks worldwide started to indicate that the recent inflation experienced by many countries could continue for a prolonged period.

A key turning point came with the Russian invasion of Ukraine in February 2022. This was an additional shock to global supply chains, which were already reeling from the impact of the COVID-19 pandemic.

China’s strict COVID-zero strategy of regional lockdowns has also put pressure on global supply chains, although restrictions have eased recently, with Shanghai’s 60-day lockdown ending in May 2022.

Labour markets improved worldwide during 2021/22. The unemployment rate in Australia moved to 3.5% in June 2022, which is the lowest in almost five decades. Unemployment rates in the USA and UK hit the lowest levels in many decades. Wages growth has accelerated sharply in many countries, but not yet in Australia, providing a further threat of sustained higher inflation.

Growing uncertainty

Central banks have begun raising interest rates aggressively to curb inflation, driving government bond yields higher in the second half of the financial year. As a result, concerns are mounting about the global economic growth outlook.

One of the classic indicators of greater uncertainty emerged at the end of the financial year. The U.S. Treasury’s 10-year bond yield fell below the two-year bond yield. Historically, this tends to be a good indicator of the market anticipating a sharp slowdown in economic growth.

Towards the end of 2021/22, there were also concerns about a slowdown in the Chinese property and construction market. Australia is a major exporter of steel to China. A downturn in this important market would greatly impact Australia’s iron ore and steel production industry.

How has this affected superannuation

Market conditions have been tough for all super funds this financial year, with many members across Australia seeing lower (and even negative) short-term returns. Higher inflation and rising interest rates have impacted both equities (shares) and fixed interest (bonds) markets.

It is rare in recent decades for both equities and fixed interest to suffer losses at the same time. The usual approach of investing across growth and defensive assets hasn’t worked as well for many funds as it has in the past.

Usually, we see bond returns go down when shares outperform and vice versa. When equities underperform, bonds can provide some protection. This hasn't been the case in the last year, and it tends to happen in times of rising inflationary concerns.

As a result, in 2021/22, high-growth super funds (more money invested in equities) did not have significantly different returns than conservative funds (more money invested in bonds).

Competitive returns

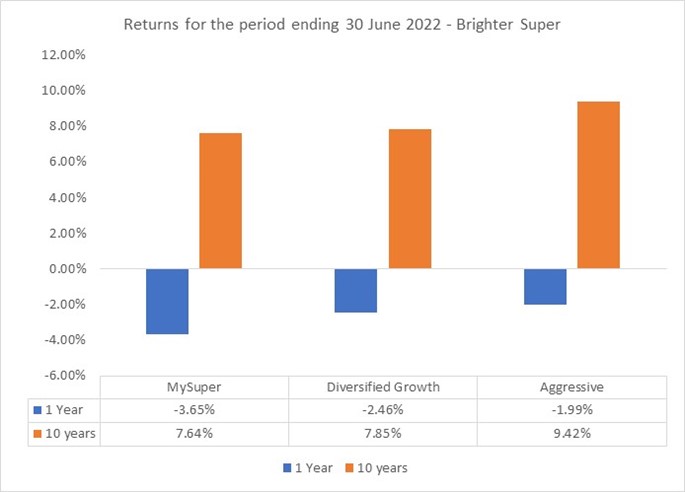

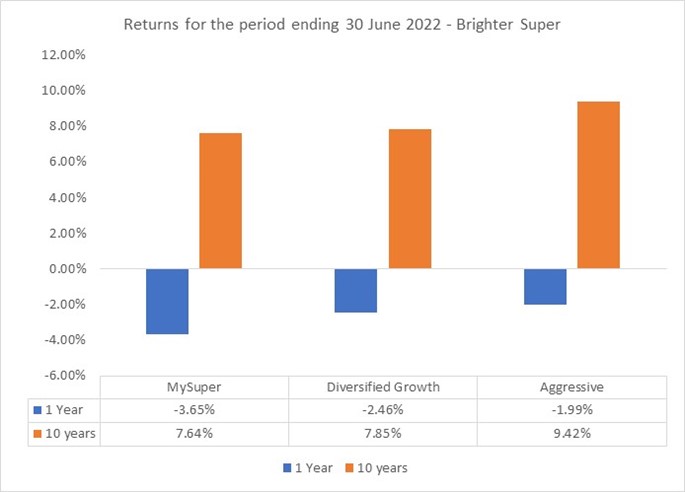

Despite the inflationary backdrop and market volatility, Brighter Super delivered competitive returns for financial year 2021/22 when measured against the other super funds.

Independent analysts SuperRatings’s June 2022 survey1 of 50 super funds included these highlights for Brighter Super options in 2021/22:

- For Accumulation accounts, three of our options were ranked in the top 5 (Aggressive, Property and Cash), and five were ranked in the top 20 (Diversified Growth, Balanced, Defensive, International Shares, Diversified Fixed Interest), with MySuper ranked at 23.

- For Pension accounts, three of our options were ranked in the top 5 (Aggressive, Property and Cash), and three were ranked in the top 20 (Diversified Growth, Defensive, Australian Shares).

- Our top performing option was Property, with 11.81% returns for Accumulation accounts and 12.94% returns for Pension accounts.

In 2021/22, the median return for all super fund’s MySuper option was negative 3.73% (SuperRatings June 20221). Our MySuper option delivered above median returns of negative 3.65%.

Key contributors to the good performance of our diversified investment options were the Infrastructure and Property asset classes. Both are well-suited to an inflationary environment and performed well despite the economic backdrop.

We are pleased with our competitive performance in this challenging year for all super funds. However, when returns are lower than usual across the industry, we understand that members will be concerned. During such volatile times, I urge members to stay focused on the long-term. Whilst past performance is not an indicator of future performance, markets tend to correct themselves and continue growing over the longer term.

The diagram below demonstrates short-term losses alongside long-term growth. It shows returns delivered by our MySuper, Diversified Growth and Aggressive options for 1- and 10-year periods up to 30 June 2022.

Data source: SuperRatings Fund Crediting Rate Survey June 2022 1

Protecting and growing

The challenging market conditions continue in 2022/23. Our diversified investment portfolio is helping to protect our members from short-term volatility and downturn. We aim to reduce risk and minimise losses by spreading investments across various asset classes.

Following our merger with Energy Super and acquisition of SPSL, our fund has increased in size and scale. We now look after almost $30 billion in retirement savings for approximately 255,000 members (as at 30 June 2022).

We are combining the strengths of all three funds to benefit all our members. For example, we are currently creating a single set of investment options for all members. We have aimed to select the best investment options across the group, reduce duplication and provide a comprehensive set of investment choices for all members. The new set of options is now available to Brighter Super account holders.

We’re still a medium-sized boutique fund, which enables us to adapt quickly to market conditions and seize investment opportunities when markets start to recover.

As always, we are staying focused on our long-term goals. Achieving solid long-term performance involves riding through many short-term peaks and troughs. While the last year’s downturn has been challenging, our MySuper option delivered 15.01% returns in 2020/21, with higher returns for some of our other growth options. Our long-term focus has enabled us to deliver an average 9% return for our default option over the last 36 years2.

We will continue building a top-performing fund, delivering the best possible retirement outcomes for our members.

What can members do?

I encourage our members to stay informed about super and engaged in how it is invested. We have a range of information and resources on our website to help you.

We also hold regular member events, both online and in-person, where we share our latest insights and updates. I host many of these events alongside our CEO Kate Farrar, and we always look forward to these discussions and the feedback we get from our members.

Before making decisions regarding your financial future, we recommend you seek advice. Brighter Super’s team of qualified professionals can give you the advice you need to make informed decisions about your super3.

We offer general advice over the phone, or you can arrange an appointment with one of our financial advisers for single issue or comprehensive personal advice. You can also book a 30-minute Super Health Check at no cost with one of our super specialists.

Independent analysts Chant West recently acknowledged our financial advisers by shortlisting us for its 2022 Best Fund: Advice Services award. We are proud to be recognised as a leader in providing advice services that are relevant and accessible for all members. Our personalised service is central to our member-focused philosophy.

Call us on 1800 444 396 to discuss the type of appointment that would suit you best.

- SuperRatings Fund Crediting Rate Survey, June 2022. Refer to superratings.com.au/research for further information about these results, including how it calculates investment returns. The information is current as at the date of the SuperRatings Survey. Investment returns are only one factor to be considered when deciding whether to invest. Past performance is not a reliable indicator of future performance.

- Returns are based on daily unit prices available to members. They are net of investment fees and taxes, and net of the 0.18% administration fee charged by the Fund. The $1.00 per member per week charge from 1 November 2020 and 30 September 2021, and $1.50 from 1 July 2019 to 1 November 2020, has not been deducted from these returns. From 30 September 2021 the $1.00 per member per week fee ceased. Past performance is not a reliable indicator of future performance.

- Brighter Super Financial Advisers are Authorised Representatives of Industry Fund Services Limited (IFS) ABN 54 007 016 195, AFSL No 232514. In limited circumstances, a Financial Adviser may also be an Authorised Representative of ESI Financial Services Pty Ltd (ESI Financial Services) ABN 93 101 428 782, AFSL No 224952. ESI Financial Services is a wholly owned entity of LGIAsuper Trustee (ABN 94 085 088 484) as trustee for LGIAsuper (ABN 23 053 121 564) trading as Brighter Super. ESI Financial Services has engaged IFS to facilitate the provision of financial advice to Brighter Super members. Additionally, Brighter Super has also engaged Link Advice Pty Limited ABN 36 105 811 336, AFSL No 258145 to provide Brighter Super members with access to limited personal advice over the phone in respect to Brighter Super products.